- Geopolitical tensions and trade policy uncertainty are injecting unpredictability into global financial markets. What seems like rock-solid market sentiment today can turn into jitters tomorrow. In this ECB Blog, we present a new risk appetite indicator to systematically track such shifts in market sentiment.

By Benjamin Böninghausen and Florian Hartmann

Market swings – important beyond the trading floor

Central banks need to keep an eye on market sentiment as it signals what investors think about the future. Investors’ willingness to take risk today is determined by their view on the broader economic outlook of tomorrow and the level of uncertainty they associate with it. This, in turn, has macroeconomic ramifications and can lead to self-reinforcing feedback loops. Periods of positive market sentiment can contribute to easier financing conditions and could boost economic activity. On the other hand, a sustained lack of risk-taking may tighten financing conditions for businesses, governments and private households. Understanding the current mood of investors is therefore vital for understanding broader macroeconomic developments and their implications for monetary policy.

There are different ways to measure the mood of investors and their risk appetite. Financial asset prices can help policymakers get broad-based, real-time information on investor sentiment. Existing market-based approaches like the Composite Indicator of Systematic Stress (CISS) focus specifically on systemic stress in the financial and banking systems. In this blog post, we present a new measure to gauge market sentiment more generally. Our indicator takes a more holistic perspective on the pricing of euro area assets beyond periods of stress. This allows us to grasp market sentiment for periods of both market optimism and market caution, commonly labelled “risk-on” and “risk-off”, and the transition between them.

How to quantify market sentiment

Let’s take a closer look. To construct the euro area risk appetite indicator, we follow the methodology of Bauer, Bernanke and Milstein (2023), who apply principal component analysis to asset prices in the United States. This statistical method makes it possible to distil information from different financial indicators into a single, easy-to-interpret indicator at daily frequency. To get a better idea of investor sentiment, our indicator is based on shifts in risk premia across different asset classes. This is the compensation investors require over a risk-free investment alternative. If markets are sensitive to risk and thus investing cautiously, they demand higher compensation in situations they deem critical. If they are optimistic about market conditions, by contrast, risk premia are lower.

At the same time, combining changing asset prices in a single index avoids overemphasising isolated spikes in market prices that emerge from specific asset classes or indicators. For example, by focusing exclusively on fear indicators in equity markets, such as the VSTOXX, we might overlook important information about risk appetite coming from bond or currency markets. Specifically, the resulting risk appetite indicator is based on ten financial variables. These include equity indices like the Euro STOXX 50, volatility indices like the VSTOXX, sovereign and corporate bond spreads, and exchange rates like that of the euro to the US dollar.

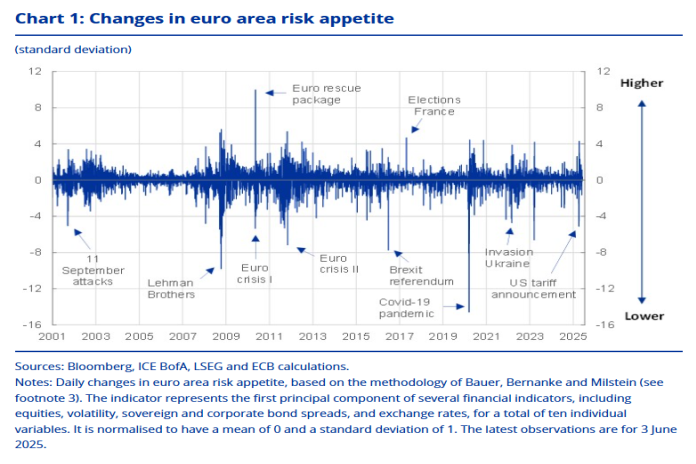

The risk appetite index, measured in daily changes, is illustrated in Chart 1. As the timeline shows, the index closely follows what economic intuition would suggest. In times of stress, risk appetite falls; in times of certainty and optimism, it rises. For instance, the recent US tariff announcement led to sharp swings in risk appetite caused by a substantial rise in global economic uncertainty. In addition, the risk appetite index was very responsive to euro area-specific events, such as the sovereign debt crisis, the Brexit referendum in 2016 and the French presidential election in 2017.

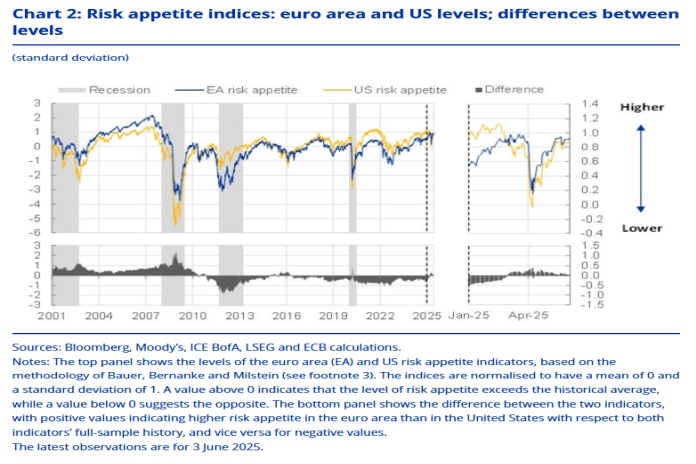

We can compute the level of risk appetite by aggregating and normalising the daily changes shown in Chart 1. This helps to more clearly identify protracted periods of strong or weak risk sentiment, thereby providing historical context and allowing for better comparisons of the relative movements between countries or regions. The top panel of Chart 2 highlights the strong co-movement across the euro area and the United States. The parallel development in market sentiment suggests a common trend on both sides of the Atlantic. The overlap is particularly striking in times of recession, as both indices display considerable dips pointing in the same direction.

These findings illustrate the link between economic activity and risk appetite, and the existence of a global factor in risk premia. Though impacted by global events, the level of risk appetite can vary significantly across different regions and countries. This is demonstrated over the observed time frame in the bottom panel of Chart 2. Regional differences in the level of investor risk appetite between the euro area and the United States become evident, especially during periods of sharp declines.

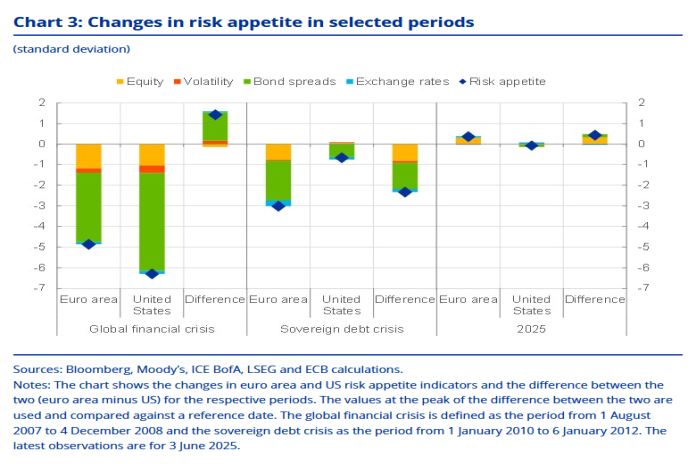

Two major episodes of financial turmoil are pertinent examples for events with a severe, albeit divergent impact on risk appetite: the global financial crisis and the euro area sovereign debt crisis. Chart 3 zooms in on how risk appetite in the euro area and the United States evolved during these episodes. For both episodes, the chart shows the changes in the levels of the euro area and US risk appetite indices (from Chart 2, top panel) and changes in the difference between the euro area and US levels (from Chart 2, bottom panel). To get a better idea what drove investor sentiment, it provides a breakdown of factors. Specifically, it attributes those changes to contributions from the equity, volatility, bond-spread and exchange-rate components of the risk appetite index.

In both cases, investor sentiment deteriorated in the euro area and the United States as economic conditions worsened. However, while the global financial crisis had a significantly larger impact than the sovereign debt crisis in both regions, the two episodes exhibit striking regional differences. For the global financial crisis, which emanated from the mortgage market in the United States, risk appetite decreased somewhat more strongly for the United States. By contrast, the sovereign debt crisis in the euro area had a visibly stronger effect on risk appetite on this side of the Atlantic. Such divergence could be seen across asset classes, though bond markets played the dominant role in driving risk appetite and the gap between the two regions.

Monitoring investor mood in recent market conditions

Finally, turning to more recent developments, Chart 3 also shows that since the start of 2025, net risk appetite has increased slightly for the euro area and remained almost unchanged for the United States. Yet, as the more detailed underlying dynamics in Chart 2 (zoom window) reveal, this masks considerable volatility in recent months. At the beginning of the year, risk appetite in the euro area – unlike in the United States – continued to rise from the already elevated levels that had persisted throughout 2024. This was followed by a rapid souring of euro area risk appetite amid trade-related uncertainty, which put an end to the temporary decoupling of euro area risk appetite from its US counterpart.

Consistent with this, more encouraging trade-related news out of the United States then drove a rebound in risk appetite in the euro area. Intuitively, the picture for the United States – from where the trade shock emanated – looks slightly less favourable on balance. Recent months have again illustrated that market sentiment can shift fast in both directions. The risk appetite indicator presented in this blog helps central banks to summarise and monitor such mood swings in real-time.

The views expressed in each blog entry are those of the author(s) and do not necessarily represent the views of the European Central Bank and the Eurosystem.

The post Reading the market’s pulse: Monitoring investors’ risk appetite appeared first on Caribbean News Global.