By Fédéric Holm-Hadulla and Sebastiaan Pool

- Central banks usually seek to align very short-term interest rates in the money market with their own policy rate. But money market rates fluctuate also for reasons other than policy. This blog shows that monetary policy is more effective if such fluctuations are small.

Discussions about monetary policy usually centre on whether interest rates should go up, down or stay the same. The complexities of how monetary policy is carried out in practice often go unnoticed. We look behind the scenes to explore a key aspect in this regard: the way central banks manage fluctuations in short-term money market rates and how this matters for the effectiveness of monetary policy.

A primer on monetary policy transmission and implementation

When the ECB adjusts its policy interest rates, it sets in motion a chain reaction in the financial system and the economy that helps it steer demand and eventually control inflation. Economists usually refer to this process as the monetary policy transmission mechanism. The initial link in this chain is the money market, where banks and other financial institutions lend and borrow money for short periods of time.

Central banks implement their policy by aligning very short-term interest rates in the money market with their policy rates. They do this with a set of tools and technical procedures collectively known as the operational framework. However, central banks typically do not fully control money market rates. In fact, these may fluctuate also for reasons unrelated to policy – for instance, owing to the ups and downs in banks’ daily liquidity needs.

In more detail, central banks provide money – or reserves – to banks and accept their deposits. Further, they set the interest rates applying to these transactions. This creates natural bounds on how much short-term money market rates would typically fluctuate: if market rates are higher than the ECB lending rate, banks would come to the ECB to borrow, as this would be cheaper than taking up money from other commercial banks in the market. In turn, if market rates are below the rate banks get from depositing reserves with the ECB, again they would rather come to the ECB to park their money at a higher return. Within this band between the ECB’s rates for lending and deposits, market rates are determined by the supply of and demand for reserves.

This system ensures that central banks have a certain degree of control over market rates. Following a recent review of how monetary policy is implemented, the ECB decided to narrow the ‘width’ of this band (for additional detail on the new framework, see also this recent blog by Claudia Buch and Isabel Schnabel). The ECB did this to “limit the potential scope for volatility in short-term money market rates”. At the same time, it kept some distance between the ECB rates to “leave room for money market activity and provide incentives for banks to seek market-based funding solutions”.

How does short-rate volatility influence transmission?

In Holm-Hadulla and Pool (2025), we present empirical evidence for why, as part of this balancing act, limiting volatility in short-term interest rates is an important consideration.

The rationale is that volatility in short-term rates creates uncertainty, and uncertainty typically leads to a preference for maintaining the status quo when it is costly to change current practice (Dixit, 1991). Banks, for example, would usually transmit a change in money market rates into the interest rates on the loans they grant to their customers. But if volatility is very high, they will be less certain that the change in money market rates will last. Hence, banks may also be less willing to alienate for instance a long-standing customer with abrupt and frequent changes in borrowing costs. Instead, with high volatility, banks will be more inclined to just wait and see.

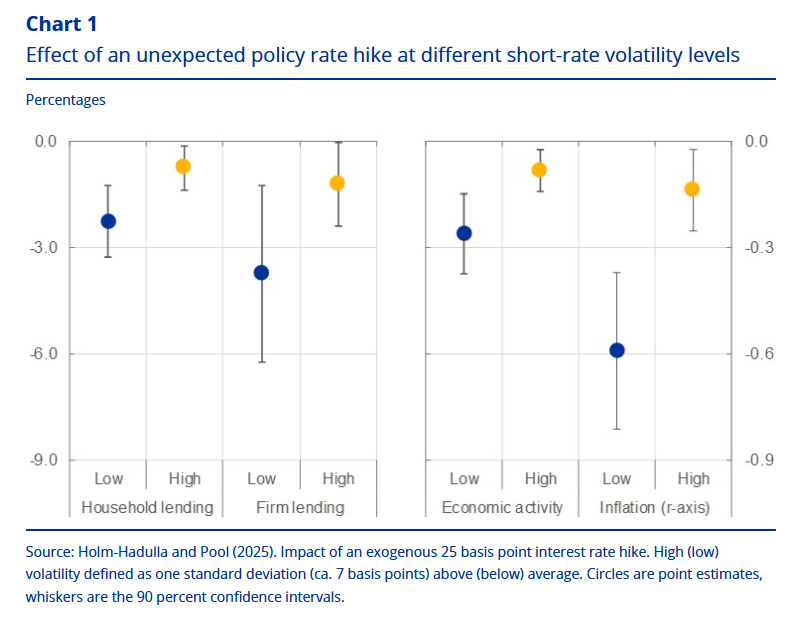

This is indeed the pattern we observe in the data: as short-rate volatility rises, bank lending, output and the economy-wide price level become significantly less responsive to monetary policy. To see this, we compare how these variables respond to a change in the monetary policy stance when volatility is relatively low and when it is relatively high. [Chart 1] illustrates the impact of volatility for the case of an unexpected interest rate hike (the results also hold for a surprise rate cut).

It shows that the reduction in bank lending to firms and households is more than twice as strong with low than with high volatility. Moreover, this dampening effect also appears at the later stages of monetary policy transmission, including the medium-term effects on output and prices. For instance, for a 25-basis-point exogenous increase in policy rates, we estimate that the price level would, over the medium term, decline by more than half a percent in a low-volatility environment, while the effect is reduced to less than a quarter percent in a high-volatility environment.

A reduced effectiveness of monetary policy would then require stronger action from the ECB to achieve its objectives; and it may mean that policy rates – during periods of low inflation – will more often hit their lower bounds. Moreover, we observe that, in years in which volatility is high on average, it also swings around a lot from month to month (so it is not constantly high, but instead very high in some months and quite moderate in others).

This further complicates monetary policy: central banks cannot simply assume that a situation of high volatility and weak transmission will persist. Instead, whenever they decide on monetary policy, it is uncertain how money market volatility will evolve. This, in turn, raises the risk of over- or underreactions to changing economic circumstances. Vice versa, containing money market volatility thus facilitates monetary policymaking.

How did we come up with the findings?

Our research strategy starts from a technique called local projections to study the economic impact of unexpected changes in monetary policy, or “shocks”. We measure the shocks via the immediate financial market moves after monetary policy announcements. We then feed these into an empirical model, which uses historical data to see how economic indicators in the euro area tend to react to monetary policy over time. This helps us better understand the causal link between policy decisions and economic outcomes.

Compared to earlier studies, a main novelty is that we allow the impact of monetary policy to differ, depending on how volatile short-term money market rates are in the period leading up to the shock. In doing so, we also ensure that the measured volatility is not itself an outcome of the current economic conditions, which could lead us to confuse the direction of causality. In particular, we focus on changes in volatility that have come as a side effect of other structural changes in the conduct of monetary policy, as opposed to reflecting current conditions.

Why does controlling volatility matter for policy?

To summarise, central banks face an interesting balancing act. With more scope for short term interest rates to move around, there is in principle more room for market forces to work, which often makes economic outcomes more efficient. However, if market rates fluctuate a lot, key actors in the economy may become more reluctant to respond to changes in monetary policy and this complicates the central bank’s task of controlling inflation. This balancing act is likely to become more prominent over the coming years: as central banks gradually reduce their supply of liquidity, market rates should become more sensitive to changes in commercial banks’ liquidity demand. The changes in the operational framework announced in 2024, including the narrower range between the ECB lending and deposit rates, will contribute to smoothening the transition to this new environment.

The views expressed in each blog entry are those of the author(s) and do not necessarily represent the views of the European Central Bank and the Eurosystem.

The post Low money market volatility benefits monetary policy transmission appeared first on Caribbean News Global.